section-1b54b5b

section-4a27993

section-40e7635

Case Studies for Two Metropolitan Markets

No matter where you live, both strategies for investment can be performed at one degree or another. Case in point, there are successful house flippers and rental home owners in Metropolitan Statistical Areas all over the United States. With the idea that either investment strategy can work in any market, the investor should focus on the quality of the market and finding the best opportunities in those areas. In this section, we will be looking at the greater Washington D.C. and Austin, TX areas and discuss why I believe these are two of the strongest markets in the nation today.

Washington D.C.

The Greater Washington D.C. area mainly consists of the northernmost counties of Virginia, like Fairfax and Loudoun, in addition to Maryland’s Montgomery and Prince George’s County. Using 2012 statistical data, It is the 7th largest Metropolitan Statistical Area (MSA) in the United States.

Washington D.C. is the Nation’s Capitol and home to more government employees than ants at a picnic. If you can think of a three-letter government agency, they are probably headquartered in this area somewhere. DC is also home to many foreign embassies, which is probably one of the reasons why a recent Brown University study named this area the 4th most ethnically diverse area in America.

According to a study by the US Census Bureau, 11 of the wealthiest 25 counties in America are located in Maryland and Virginia, with Loudoun and Fairfax taking the #1 and #3 spots respectively. As long as the Federal government continues to pump money into this region, and the technology and business sector remains strong, it’s safe to say that this MSA is not going to be hit with a Detroit-like crisis anytime soon.

Washington D.C. is the perfect place for an investor who wants to focus on a high appreciation strategy. According to a Zillow study, over a 10 year period from October 2000 to October 2010, Washington was the best performing city in the nation and had a 9.4% annualized return in home values. That is almost three times higher than the 20th best performing city, Chula Vista in California, which had a 3.5% annualized return.

Seems like a no-brainer to jump in to this market right? Sure, just cough up half a million dollars and you’re good! According to the Office of the Chief Financial Officer in Washington D.C., the average sales price of a single-family home was $713,000. Granted, this is the average home in the heart of the nation’s capitol. If you go out into the suburbs, the average price can be $200,000 – $300,000 less! Buying a single-family home in this market is expensive and can prevent a lot of investors from participating. However, there are other options if the investor is open to purchasing town homes, condos, fixer-uppers and/or distress sales.

Here’s an example of a $179,900 town home for sale as of July 2014:

3br/1ba townhouse at 5817 Falkland Place located in Capitol Heights, MD. Capitol Heights is located East of DC, approx. 10 miles and 30 minutes away.

The property has been fully renovated and has a new roof, HVAC, carpet, energy-efficient windows and all appliances. It was built in 1983 and is 1168 SF. It could probably rent for $1600/mo and could achieve a 7% pre-tax investment rate of return if purchased with cash and as high as 14% return with a 25% down payment.

Advantages:

- High performing cash-flow properties in a historically high-appreciation area.

- More forgiving area for “mistake” purchases – Exit strategy is quicker in high appreciation area

Disadvantages:

- Townhomes and condos don’t appreciate as quickly as single family homes

- Townhomes and condos have more “hassle-factor” with neighbors – shared walls, and sometimes floors and ceilings

- Townhomes and condos attract a different renter persona than single family homes

- Townhomes and condos will typically be 5-10+ years old in this area and price range.

- More costly to purchase a single family home ($400k – $700k avg)

- According to the Demand Institute, the DC MSA is expected to see only a 7% increase in the median price of a single family home from 2012 through 2018. This is the lowest for the 50 largest U.S. MSAs.

Washington DC in the Press:

- Emerging Trends in Real Estate 2016 by Urban Land Institute – Overall Real Estate Prospects for Investment, Development and Homebuilding – #51

- Rockville, MD – America’s Best Places to Live and Visit – #11

- Wolftrap, VA and Bethesda, MD – 10 Best Places for the Wealthiest Retirees

- Falls Church City, Loudoun County, Fairfax County, Arlington County, Stafford County VA and Howard County, MD – America’s Top 10 Richest Counties in 2014

- Arlington, VA and Washington D.C. – Top 10 Best Cities for Families 2012 – #6

- Washington, DC – America’s Best Cities for Foodies – #18

- Washington, DC – America’s Top 20 Healthiest Cities – #2

- Bethesda, MD – Best Places to Live and Launch a Business – #5

- Leesburg, VA- Best Places to Live and Launch a Business – #31

- Loudoun, Fairfax, Arlington, Prince William – Healthiest Counties in Virginia – #1, #2, #3, #8

- Montgomery, Howard, Frederick, Calvert – Healthiest Counties in Maryland – #1, #2, #3, #8

Austin, Texas

The population of the Austin MSA is one-third the size of Washington’s MSA and ranks as the 35th largest MSA in the United States. However, it is the fastest growing when compared to MSA’s with a population over 1 million. Austin grew 6.88% from 2010 to 2012, more than double Washington’s 3.09% growth. The greater Austin area consists of cities such as Georgetown, Round Rock, Cedar Park and San Marcos in Williamson, Travis, Hays, Bastrop and Caldwell Counties.

The population of the Austin MSA is one-third the size of Washington’s MSA and ranks as the 35th largest MSA in the United States. However, it is the fastest growing when compared to MSA’s with a population over 1 million. Austin grew 6.88% from 2010 to 2012, more than double Washington’s 3.09% growth. The greater Austin area consists of cities such as Georgetown, Round Rock, Cedar Park and San Marcos in Williamson, Travis, Hays, Bastrop and Caldwell Counties.

Austin is to Texas, what San Jose is to California. Instead of the nickname “Silicon Valley,” this area of Texas has been referred to as “Silicon Hills” due to the diverse high-tech firms that are located in the Texas Hill Country. These companies include Apple, 3M, Advanced Micro Devices, Freescale Semiconductor, IBM, Dell, AT&T, Google, Facebook, Applied Materials, National Instruments and many more.

Austin continues to brand itself as the “Live Music Capitol of the World” and is known for hosting the largest music festival in the world, South by Southwest. This is the highest revenue-producing event for the Austin economy. Austin is also home to the Circuit of the Americas, the newest Formula one racetrack in America, expecting to generate up to $5 billion over the next 10 years for Texas.

Everybody knows that Texans are proud to do things differently and that everything is big in Texas. This includes job creation. Due to Texas’ business-friendly climate and free market economy, Texas added almost more jobs (265,000), from 2009 through 2011, than almost the entire US combined (266,000)! The real estate market is also strong and according to Mark Sprague, the State Director of Information Capital, Austin has averaged 4.2% appreciation since 2000 and has avoided wild 45+% price swings the bubble states had (CA, FL, NV, AZ, etc.). Single digit appreciation keeps speculators and short term investors from dominating sales. If Texas was a sovereign nation it would have the 14th largest economy in the world by Gross Domestic Product.

Many investors prefer the buy and hold strategy when investing in Austin because the average price of a single family home was only $325,926 in May 2014 and new construction can be found for much lower.

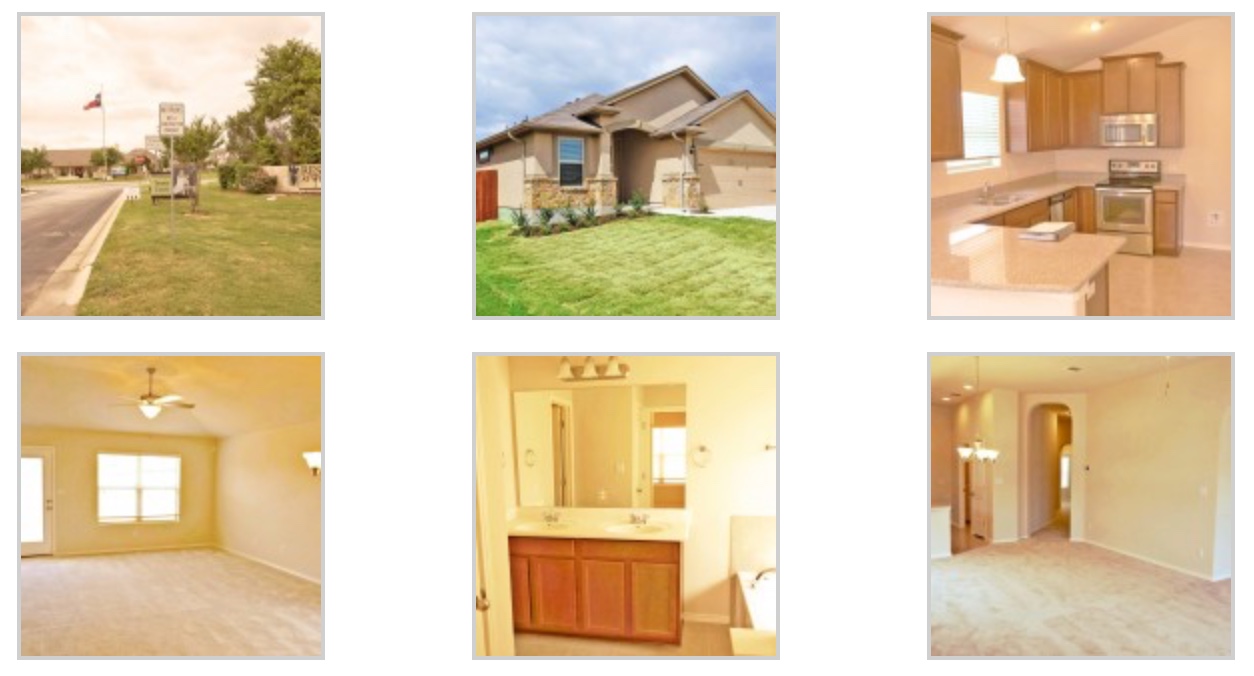

Here’s an example of a $166,000 single family home for sale as of July 2014:

3br/2ba new energy-efficient, 100% ENERGY STAR certified home built by Meritage Homes. Located in Pflugerville, approximately 15 minutes from Round Rock and 30 min from Austin.

The property includes a 2 car garage and will be built with soaring 10′ ceilings and energy-efficient spray-foam insulation. It is 1402 sf and everything about the home is brand new. In fact, I helped an investor purchase this floor plan and pick a lot to have this home built over the next several months. It could probably rent for $1450/mo and could achieve a 6% pre-tax investment rate of return if purchased with cash and as high as 10% return with a 25% down payment.

Advantages:

- Affordable ($150k – $250k) recent or New construction single family homes = longer term hold potential

- Single family homes take better advantage of market appreciation over townhomes, condos, and multifamily

- Higher potential to attract long-term renters and families

- According to the Demand Institute, the median price of homes in the Austin MSA will grow by 15% from 2012 through 2018.

Disadvantages:

- Appreciation rate is steady, but historically slow = longer time horizon for holding the property

- Continuing new construction in neighborhoods = longer time horizon for holding the property

Austin continues to benefit from diverse job creation ranging from service jobs to higher-end STEM and technology, advertising, media, and information (TAMI) positions. Austin remains an attractive place to live for all generations. If there is a concern about Austin, it may be that the market is growing faster than the local infrastructure. – Urban Land Institute

Austin, TX in the Press:

- Emerging Trends in Real Estate 2016 by Urban Land Institute – Overall Real Estate Prospects for Investment, Development and Homebuilding – #2

- Austin, TX – Top 10 Best Cities for Families 2012 – #4

- Austin, TX – America’s Best Cities for Foodies – #15

- Round Rock and Austin, TX – FBI’s Safest Cities in America with population over 100,000 – #45 and #205

- Leander, TX – Top 100 Safest Cities in America with population over 25,000 – #95

- Austin, TX – America’s Top 20 Healthiest Cities – #16

- Austin, TX – Best Cities to Start a Business – #3

- Georgetown, TX – Best Places to Live and Launch a Business – #2

- Austin, TX – Best Places to Live – #3

- Williamson, Hays, Travis – Healthiest Counties in Texas – #2, #7, #8

- Austin, TX – FreddieMac Multi-Indicator Market Index used to describe a stable housing market – #2